UK banking group, Close Brothers, recently conducted a survey into changing attitudes toward responsible investing. This catch-all term can include ethical and impact investing, as well as ESG, an investment approach that focuses on environmental, social and governance issues.

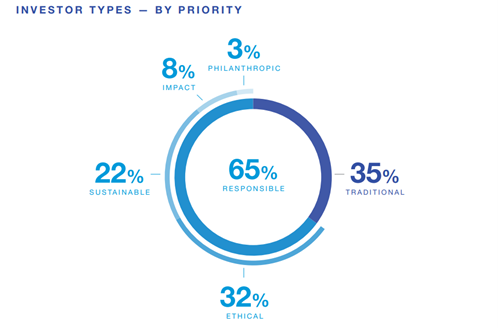

It found that 65% of respondents saw investing responsibly as a priority, with just 35% concerned only with maximising their financial returns.

Source: Close Brothers

The survey also dispelled several myths that surround responsible investing. According to the report, sustainable investing is no longer the sole preserve of millennials, nor do investors believe that staying true to their values means accepting poorer returns.

What else does the survey tell us about changing attitudes toward responsible investment and what do they mean for your money?

Responsible investing goes mainstream

The Investment Association confirmed last year that over £7.1 billion was placed in ESG funds between January and October 2020. That constitutes a near 400% increase from the same period in 2019.

FTAdviser, meanwhile, reported that responsible funds saw net inflows of nearly £1 billion in September 2020 alone.

Although attitudes to ESG have been changing in recent years, the timing of these huge increases also suggests that the coronavirus pandemic may have played a part.

In March 2020, as the UK went into lockdown, the first news reports emerged of resurging nature and decreasing air pollution. High-profile stories documenting the response of large companies to the crisis also placed working conditions in the spotlight, putting pressure on firms such as Wetherspoons and Waterstones to treat their staff well.

While the impact of the pandemic on the stock market was clear, continued coverage of environmental, social, and governance factors led many to re-evaluate their investment practice.

A myth-busting year

In the early years of responsible investing, it was assumed that placing your money in funds that aligned with your values would mean sacrificing returns. But was this the case during the coronavirus pandemic?

In the US, S&P Global Market Intelligence looked at 26 ESG funds with more than $250 million in assets under management during the year from 5 March, 2020, to 5 March, 2021. It found that 19 of the 26 ESG funds outperformed the S&P 500 (an index representing 500 of the US’s biggest companies).

In the UK, investment manager Fidelity International researched stock performance based on their ESG rating. Its report revealed that in the first three quarters of 2020, stocks with higher ESG ratings had better returns for every month apart from April.

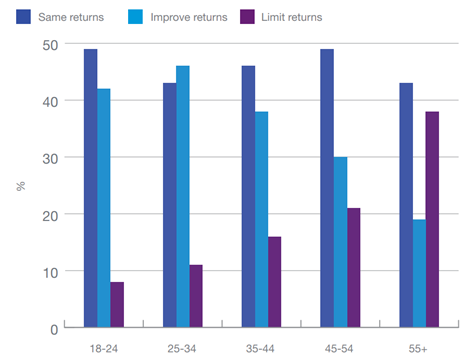

Interestingly, while the lower returns myth was largely dispelled during the pandemic, discrepancies in understanding across age groups remain.

Source: Close Brothers

While 85% of respondents in the Close Brothers survey believed that investing responsibly would provide either the same or improved returns compared to traditional investing, perception alters with age. Over-55s are most likely to see responsible investing as limiting investment returns, while those between 25 and 34 have the most confidence in its performance.

The future of responsible investing

Earlier this month the world’s media descended on Cornwall as world leaders met for the G7 summit. While the outcome of the talks – in terms of tangible commitments on climate change – proved disappointing for many, November will see world leaders return to the UK. Glasgow will be hosting the UN climate change conference, GOP26.

Issues of climate change and sustainability, spearheaded by the likes of Greta Thunberg, David Attenborough, and Extinction Rebellion will continue to dominate headlines in the years ahead.

As companies look to stay within the parameters of the Paris Agreement – and retain investors with priorities that are increasingly environmental and responsible – the market will need to keep pace.

This will likely lead to an increase in responsible investment offerings, as well as greater scrutiny from consumers and the industry as a whole.

Get in touch

Close Brothers found that only 35% of respondents considered themselves “traditional” investors – characterised as investing solely to maximise their returns.

If you’d like to talk to HDA about better aligning your investment choices with your values, please get in touch. Email enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.