Recent figures from the Office for National Statistics (ONS) confirm that inflation for April stood at 9%.

The Bank of England (BoE) meanwhile, has confirmed that the current cost of living crisis is set to continue. The Bank has warned that inflation could rise above 10%, with a return to its 2% target not predicted until 2024.

Managing your household budget, your savings and investments, and your retirement income during periods of high inflation presents some unique challenges.

So, why is inflation rising, what does it mean for your finances, and what can you do about it?

Keep reading to find out.

Many factors have combined to create a continued rise in inflation

The sharp rise in UK inflation began in 2021 as Covid restrictions were lifted.

While the pandemic had led to financial hardship for many, others had been left with “accidental” savings. When restrictions lifted, these consumers wanted to start buying again.

This should’ve been good news for the economy, except that a lack of availability of some goods and a global supply crisis meant products weren’t readily available, raising prices worldwide.

The rising cost of oil and gas has been further exacerbated by Russia’s invasion of Ukraine and further Covid restrictions in China.

The overall effect of rising prices is an increased cost of living for you as the price of goods and utilities you buy increases.

This can make household budgeting more difficult, lower the effective value of your cash savings, and mean you need to revisit your retirement plans.

Here are 5 simple tips for managing your finances during periods of high inflation

1. Check if you’re holding too much cash in your emergency fund

An emergency fund – especially as your family’s main breadwinner – is crucial.

Keeping between three and six months’ worth of household expenditure in an easily accessible account means that bills and other commitments can still be paid, even if your income stream is cut off.

During periods of high inflation, though, keeping too much of your wealth in cash accounts isn’t a good idea.

Savings rates have been low since the 2008 global financial crisis. The BoE’s recent base rate rise – up from 0.75% to 1% – leaves it languishing far below inflation. As the cost of living continues to rise, your cash savings will be effectively losing value in real terms.

Checking in with your rainy day fund allows you to ensure you have enough to cover an emergency, without exposing too much cash to the damaging effects of inflation.

2. Pay your future self first by increasing your pension contributions

Effective household budgeting is always crucial, but with shopping and energy bills rising, you’ll need to manage your day-to-day expenses without compromising on future savings.

Pay your future self first each month by making tax-efficient contributions to your pension. Be sure your fixed expenses, like household bills, are covered too, and then budget with what remains.

The tax relief your pension contributions attract, plus the potential for inflation-beating investment returns and compound growth, mean that you will reap the rewards later in life.

It’s important to remember that investments can fall as well as rise but you might find that the biggest financial risk is not taking enough risk.

3. If you have long-term goals, consider investing

Investment should only ever be considered if you have a long-term goal in mind. Ideally, one that is five to 10 years away or more.

If you do, channelling some of your disposable cash into an investment could give your money the chance to make inflation-beating returns.

Understanding your attitude to risk and your capacity for loss is key. At HDA we can help you decide if investing is right for you.

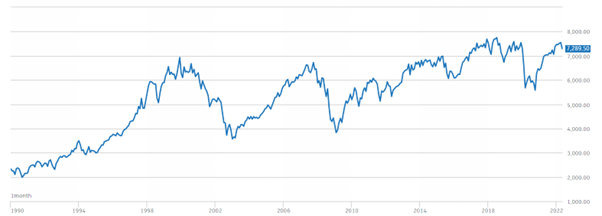

A look at the FTSE 100 for the last 30 years highlights the general upward trend of the markets.

Source: London Stock Exchange

While there are several dips – including around the time of the Iraq War in the early 2000s, the global financial crisis of 2008, and the coronavirus pandemic – it is these periods of short-term volatility that a long-term investment hopes to ride out.

If you think you have cash savings that could be working for you, get in touch now and see how we can help.

4. Revisit your retirement options and how you manage your pension income

Ensure that your retirement plans are realistic and increase your contributions if you can afford to, where a potential shortfall exists.

You’ll need to think carefully about your retirement options too.

Opting for an increasing annuity is one way to combat rising inflation. You’ll receive regular payments that rise each year, helping to ensure your fixed expenses like household bills are covered, even as the cost of living rises.

An escalating annuity will mean that your initial payments are lower, so be sure to factor this into your planning or speak to us.

Taking flexi-access drawdown could be another option. Flexible withdrawals mean that you can take only what you need. The rest stays invested and so has the potential for continued growth (as well as the risk of a potential fall).

You’ll need to budget carefully to ensure you don’t take too much. Not only could you run out of retirement income, but any excess funds you take are likely to sit in cash and so lose value in real terms.

5. Seek advice

A robust, long-term plan will be based on your dream financial future. It will consider potential changes to the global economy, as well as your attitudes to risk and your long-term goals.

At HDA, we can help you budget through the current cost of living crisis, while ensuring you don’t jeopardise your future financial stability.

From managing pension contributions and household bills now, to managing your retirement income over the decades to come, we’ll constantly revisit your plan to make sure you’re on track.

Get in touch

If you’re worried about the effects of high inflation on your long-term financial plans, we can help. Please get in touch via email at enquiries@hda-ifa.co.uk or call 01242 514563.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.